Yesterday : SINCE TIME BEGAN : CAVEAT : IN TRUTH WE TRUST : Tomorrow

POPULATION CLOCK : DEBT CLOCKS : DOOMSDAY : CLIMATE CLOCK : POVERTY CLOCK

1 250 709 1809

This Publication Does Not Intend To Specifically Endorse The Work Of The Following Enterprise Reports

Posted December 3rd, 2024

Within The Framework Of The Thoughts Of John Kenneth Galbraith

Predicting a global financial sector meltdown in 2025 is challenging, as it depends on various economic factors and unforeseen events. Here are some key points from recent analyses:

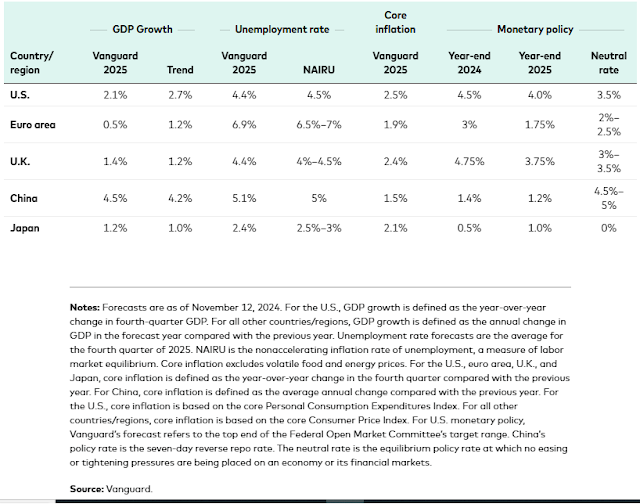

Economic Outlook: According to Vanguard's 2025 economic outlook, global inflation has slowed, and the U.S. economy shows resilience with strong growth and falling inflation 1

However, emerging risks such as trade tariffs and stricter immigration policies could impact growth and inflation dynamics .Recession Risks: J.P. Morgan estimates a 35% probability of a recession by the end of 2025

- High interest rates and a cooling labor market are potential factors that could contribute to economic slowdowns .

Market Predictions: Some economists warn of a significant market crash in 2025, potentially surpassing the 2008 financial crisis 4

- This prediction highlights the possibility of severe declines in major stock indices like the S&P 500 and Nasdaq .

While these insights suggest potential risks, they also indicate that the global financial sector's future is uncertain and influenced by multiple variables. It's essential to stay informed and prepared for various scenarios.

Market Predictions: Some economists, like those from BCA Research, predict a significant market crash in 2025, potentially leading to severe declines in major stock indices such as the S&P 500 and Nasdaq

- This prediction is based on the expectation that the Federal Reserve might not act swiftly enough to prevent a recession [5].

BCA Research is a leading independent provider of global investment research, founded in 1949 and headquartered in Montreal, Canada

. They offer a wide range of analysis and forecasts on major asset classes and economies to help clients make informed investment decisions . Their research covers global macroeconomic trends, geopolitical strategies, regional market analyses, and specific asset classes like commodities and fixed income .BCA Research is known for its flagship publication, "The Bank Credit Analyst," and provides insights through various formats, including reports, webcasts, and custom client calls

They serve a diverse clientele, including asset managers, hedge funds, pension funds, and central banks

Sidebar

"The Bank Credit Analyst" by BCA Research is widely regarded as a reliable and influential source of investment research. It has a long history of providing in-depth analysis and forecasts on global economic trends, financial markets, and asset classes

The publication is known for its rigorous methodology and comprehensive approach, which helps investors make informed decisions

However, like all investment research, it is important to remember that predictions and analyses are based on available data and models, which can be subject to change due to unforeseen events and market dynamics. Therefore, while "The Bank Credit Analyst" is a valuable resource, it should be used in conjunction with other research and insights to form a well-rounded view.

Buckley & Galbraith Debate Reaganomics : Tax Reduction vs Social Safetynet